The 6-Week Problem: Why Corporate Banking Is Stuck in First Gear

While banks have invested heavily in Salesforce as their central system of record, a critical gap remains: the documents.

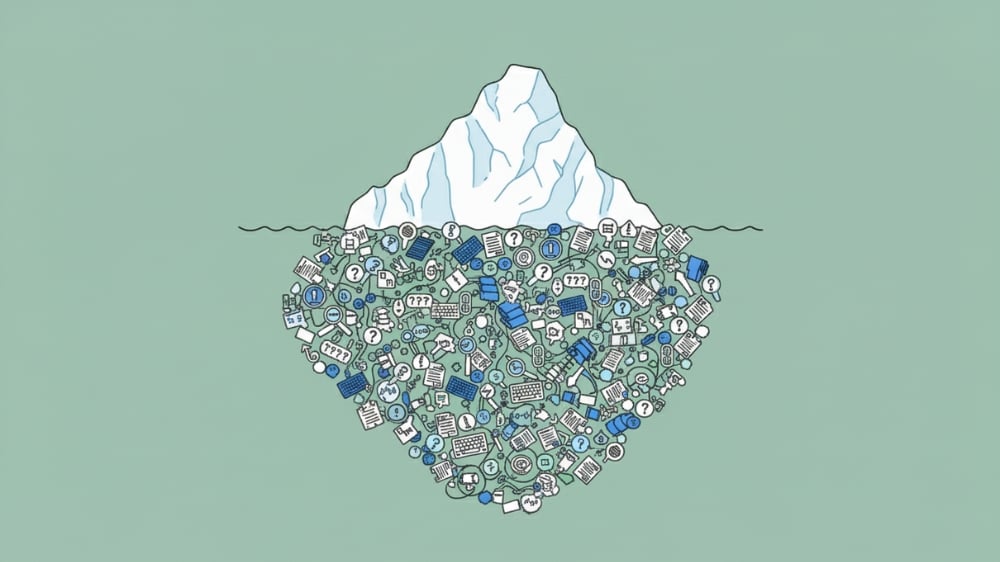

In corporate banking, precision and speed are the currency of trust. Yet, for an industry built on high-value transactions, its most critical process, client onboarding, is often its slowest. While banks have invested heavily in Salesforce as their central system of record, a critical gap remains: the documents.

Recent 2025 analysis of UK corporate banks found the average client onboarding time exceeds six weeks. This delay isn’t just an internal inconvenience; it’s a primary business threat. New 2025 data shows a record 70% of financial institutions have lost clients due to slow or inefficient onboarding. This is the “Six-Week Problem,” and its roots run deep in fragmented, manual workflows.

The Root of the Problem: Fragmented Workflows

The delay isn’t due to a lack of effort; it’s a failure of architecture. A single new loan agreement requires complex coordination across Sales, Legal, Risk, and Compliance. In most banks, these teams work in silos, using disconnected systems.

This reliance on manual work is widespread. A 2025 report from the Global Banking and Finance Review found that 40% of financial firms admit that up to half of their financial data is still managed manually. This chaos looks familiar to any relationship manager:

- Each team works from its own document version, creating duplication.

- Approvals are chased via email, with no central visibility.

- Data is manually re-keyed from Salesforce into Word templates, introducing errors.

The result is lost time, frustrated teams, and, critically, slower revenue realisation. The entire process is held back, creating a poor first impression for a new corporate client.

The Solution: Embedding Automation Within Salesforce

The fix for the six-week problem is to stop managing documents outside your system of record. The answer isn’t another standalone tool; it’s to bring the document lifecycle inside the platform you already trust.

By embedding document automation workflows directly within Salesforce, banks can generate documents directly from verified data in Financial Services Cloud. This allows them to route documents automatically for approval and maintain a complete, auditable version history from the first draft to the final signature, all within a single environment.

This embedded approach directly tackles the 6+ week delay. In fact, Salesforce customer reports show that aligning data and documents in this way can lead to a 29% decrease in sales cycle time.

From Bottleneck to Breakthrough

Corporate banking will always be complex, but that complexity no longer has to mean inefficiency. The real challenge isn’t the volume of documents; it’s the way those documents move.

When document generation, collaboration, approval, and compliance all live inside Salesforce, processes that once spanned weeks can be completed in days. This allows Relationship Managers to focus on clients instead of coordination.

By solving the six-week problem, banks can deliver the accuracy regulators demand and the responsiveness that 70% of clients now expect.

Learn more about the benefits of document automation: Download our E-guide on document automation in corporate banking.